Greater Toronto Area Rental Apartment Market

The Average Rent for All Property Types in the GTA has Declined by 8.7% Annually in July 2020

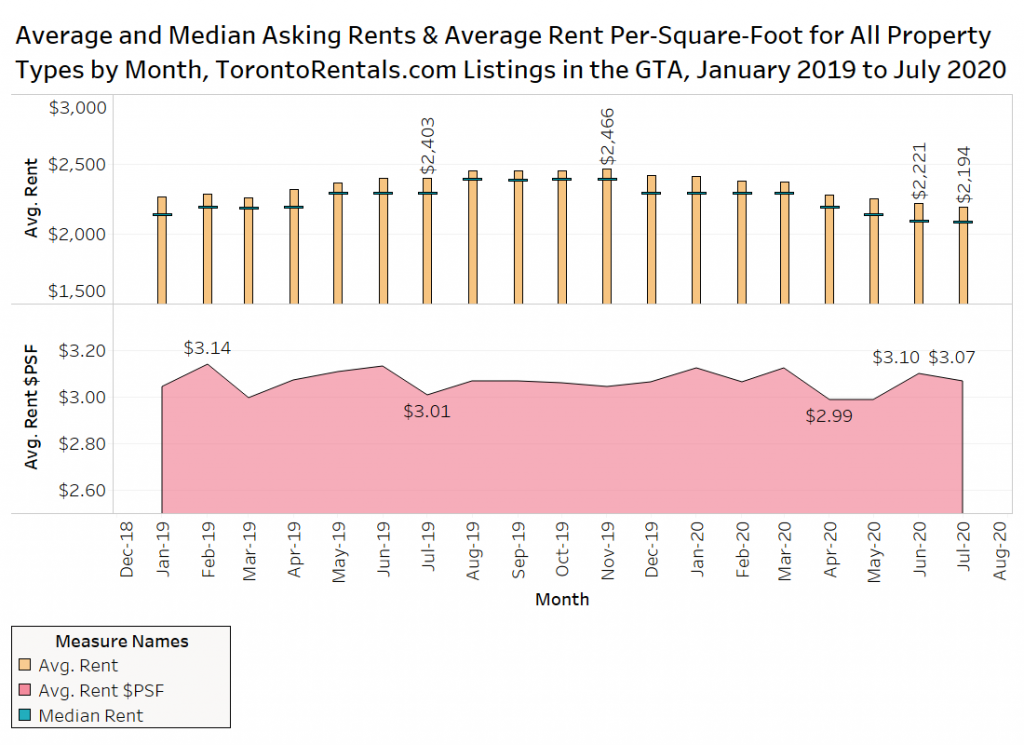

The chart below presents data on the average (yellow vertical bar) and median (horizontal line) monthly asking rent for GTA rental listings for all property types (basement apartments, rental apartments, condo apartments, townhouses and other single-family homes).

The average rent was $2,194 per month in July, marking the 8th consecutive monthly decline. The average rent is down 1.2% monthly, and 8.7% annually. The median rent is down 0.2% monthly and 8.9% annually.

A smaller sample size of listings have their unit size available, which allows for the calculation of the rent per square foot. The figure declined slightly month over month, but increased year over year by 2% to $3.07 per square foot (psf).

Average Rental Rates by Property Type

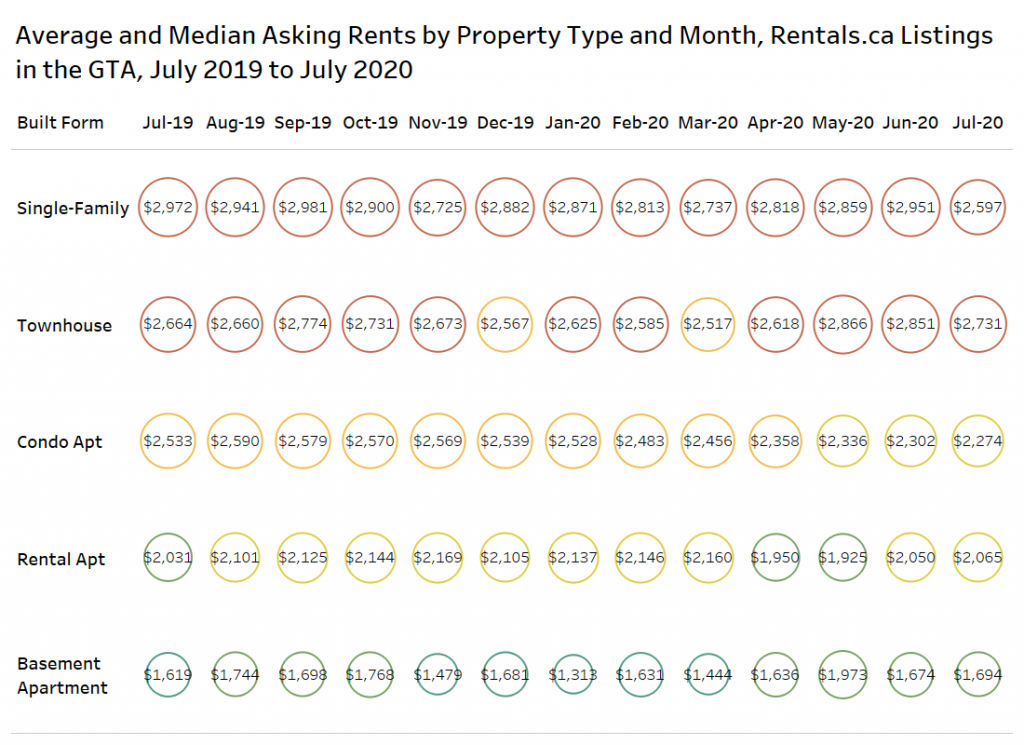

The average rent by property type in the GTA from July 2019 to July 2020 is presented in the chart below. The sample size of single-family, townhouse and basement apartment listings is not large, which leads to monthly volatility in the results.

Landlords are Asking $260 per Month Less for Condominium Apartments on Average in the GTA in July 2020 Compared to July 2019

In July of this year, the average single-family property was more than $350 cheaper per month than July 2019 ($2,606 vs $2,968), while townhouses rental rates were slightly higher.

The bulk of the listings are for condominium apartments and purpose-built rental apartments, with condos offered at about $260 less in July 2020 versus July 2019.

After a three-month COVID-related dip from April to June of this year, the average rent for rental apartments was higher in July of this year versus the same month last year ($2,065 vs $2,030).

The Average Asking Rent in July 2020 for GTA Rental Apartments has Increased by 2% Annually

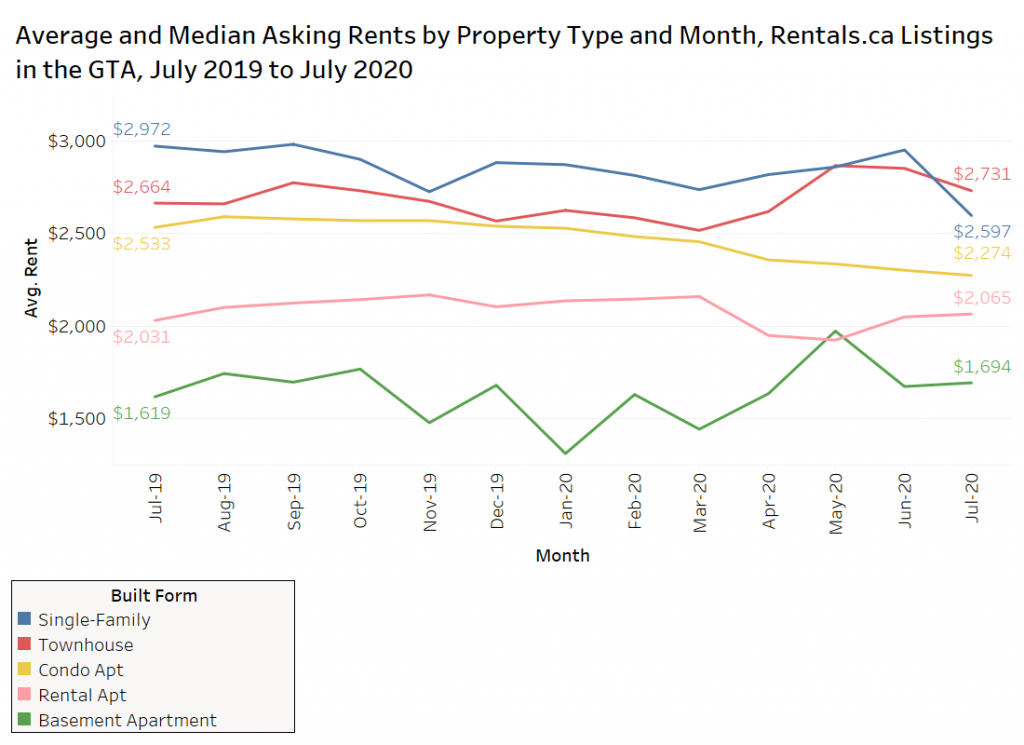

The same average rent data as the chart above is presented in a line graph below. There has been minimal growth in the average rent annually for rental apartments, while condo apartment rents have trended downward. The average rent for rental apartments is up 1.7% annually to $2,065 per month, however, condo rental rates are down 10.2% annually.

Average Rental Rates by Municipality

The Average Rent in the Former City of Toronto is Down 11% Annually in July

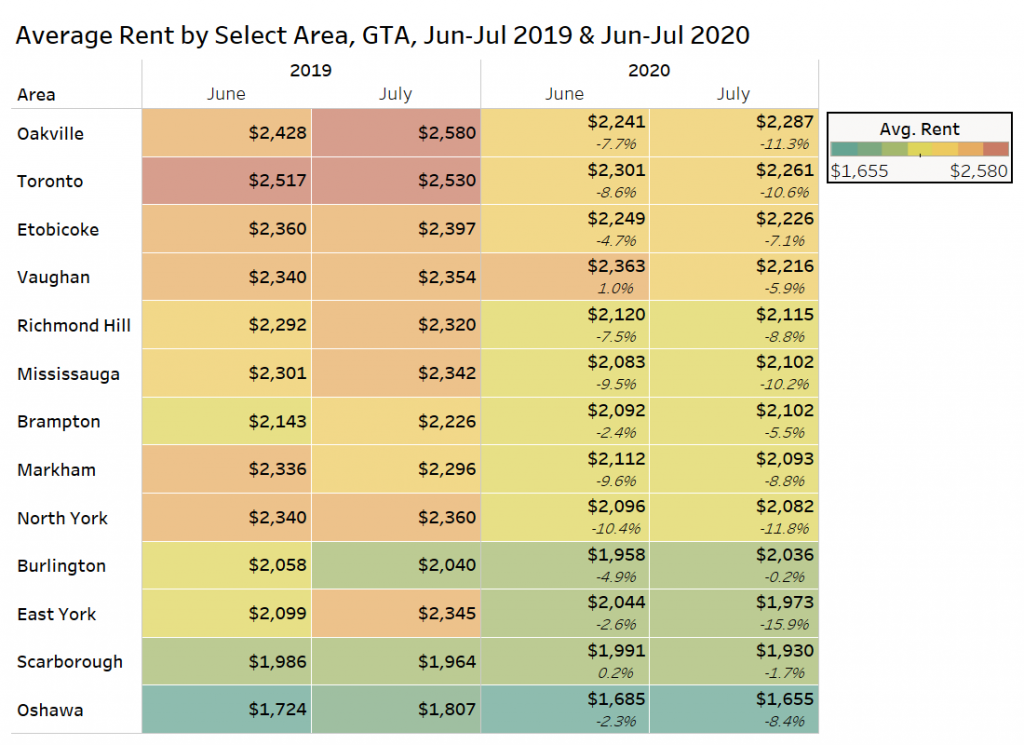

Figure 4 below looks at the average rent for all property types (singles, semis, row, condo apartment, rental apartment, basement apartment) by municipality and former municipality in the GTA in June and July in 2019 versus June and July in 2020. Also shown in 2020 is the annual change in average rents.

There are a number of areas experiencing double-digit annual rent drops: East York at 16%, North York at 12%, Oakville and Toronto at 11%, and Mississauga at 10%. The Toronto referenced in this chart is the former City of Toronto (pre-amalgamation boundaries) which had asking rents drop from $2,530 in July 2019 to $2,261 in July 2020. There were no markets that experienced an increase.

Rental Rates by Property Type in Old Toronto

Within the former City of Toronto (also referred to as old Toronto), condo apartment rents continue to decline and rental apartment rates have stabilized after a big run-up in 2019 and a sharp decline during the first few months of the pandemic.

Rental Apartments Experienced 17% Annual Rent Growth in January 2020, Dropping to 2% Growth in July 2020

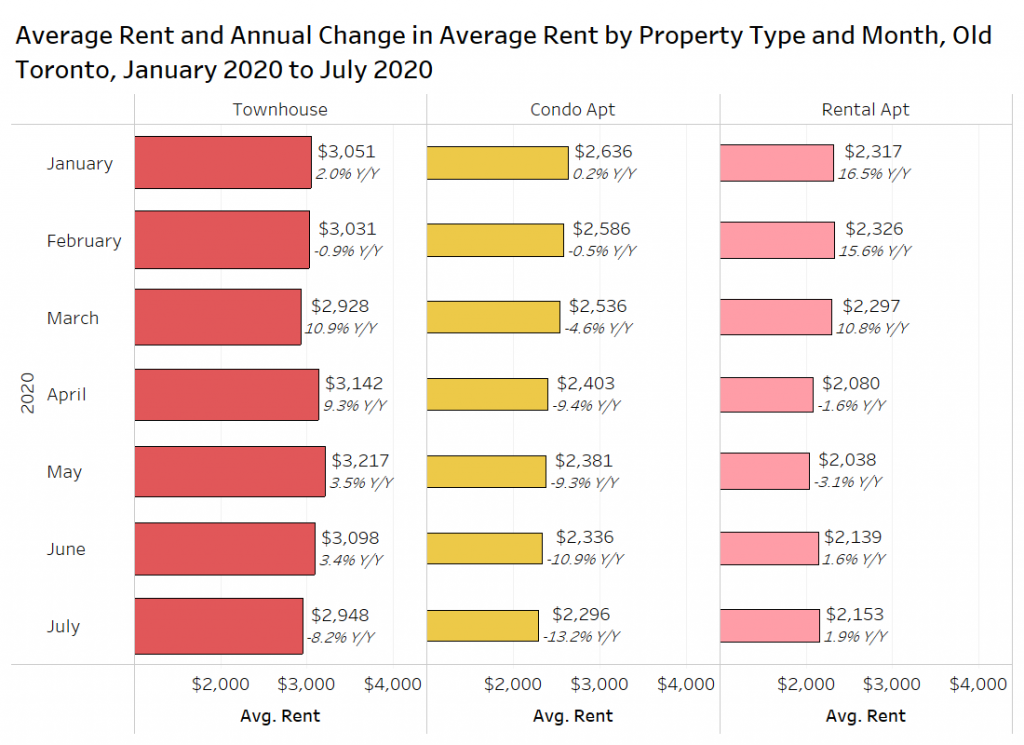

The chart below presents data on the average rent and annual change in average rent for townhouses, condominium apartments and rental apartments from January 2020 to July 2020 in old Toronto.

Townhomes have generally fallen in the range of $2,925 to $3,100 per month this year, and the annual growth rates have jumped around due to the limited townhouse listings on Rentals.ca.

Condo apartment rents have trended downward quickly and went from positive annual growth in January to a 13% annual decline in July.

Rental apartments were hot in 2019, and the January 2020 annual growth rate was just under 17%. COVID-19 and the lack of demand that ensued resulted in a quick drop in the average rent, which turned negative by April. However, average rent has trended up the last two months, and the annual growth rate was about 2% in July 2020. Keep in mind that incentives are not netted out, and several new apartment buildings are offering one and even two months of free rent.

Rental Rates Per-Square-Foot in Old Toronto by Apartment Tenure

The composition of listings on Rentals.ca changes frequently as units are leased and new buildings completed, and a flood of listings come online. This often makes it difficult to compare the average monthly rent over time, especially with unit sizes shrinking dramatically over the past 15 years.

Looking at the rent per square foot of apartments helps control for the size of suites, when comparing rent levels over time. Note that not all units for rent on Rentals.ca have square footage listed by the landlord or property owner — there is likely a slight skew toward newer units where the size of the suite is more likely to be known. The quoted rental rates per square foot are probably slightly higher than the actual rates, but the main objective of this analysis is to ascertain the movement in the market, not necessarily the actual rent levels which are drastically different across Toronto neighbourhoods.

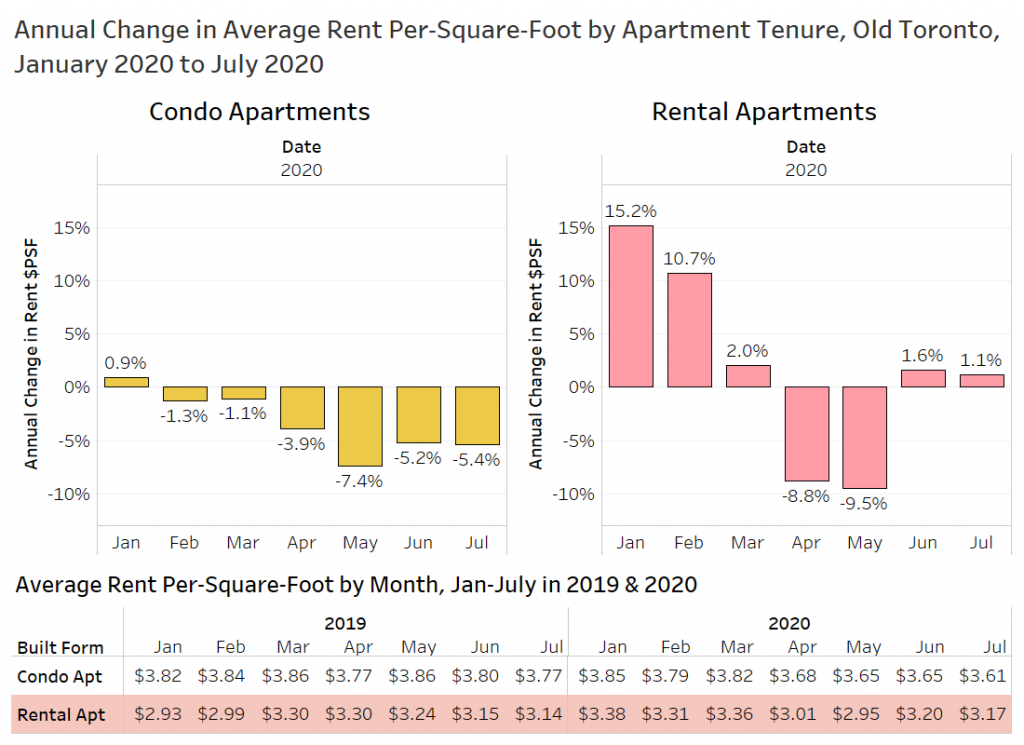

The rather puzzling divergence in condo rental rates and purpose-built apartment rental rates is broken down in the chart below.

Condo Rental Rates Per-Foot down 5% Annually while Rental Apartment Rates Per-Foot Rise by 1% Year over Year

The average rent per square foot for condominium apartment listings on Rentals.ca in July of 2019 was $3.77 psf, dropping 5.4% annually to $3.61 psf in July of this year.

There was a dramatic drop in the rent per square foot for rental apartment listings on Rentals.ca during the pandemic, with April’s $3.00 psf a 12% monthly decline from March. However, the average rent per square foot in July is back up to $3.17 psf, a 1.1% annual increase. As noted earlier in this report, the purpose-built rental apartment market was hot in Toronto before the pandemic, with the $3.38 psf average rent level in January up 15.4% year over year (January 2019: $2.93 psf).

Rental Rates by Neighbourhood in Toronto for Condo Apartments

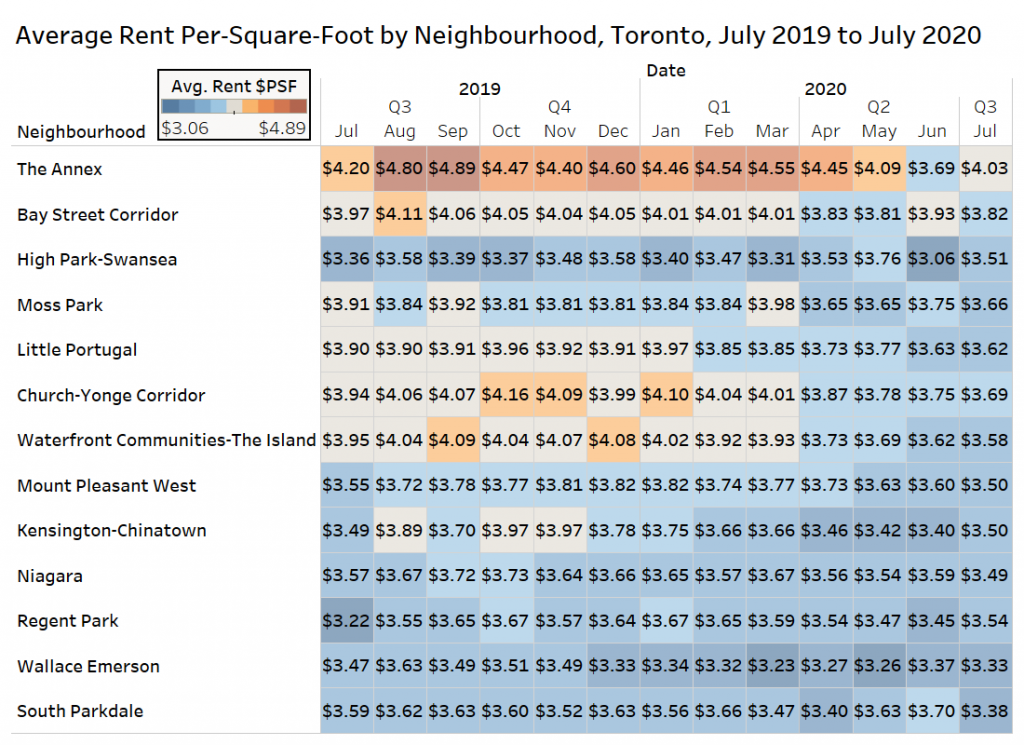

When examining a number of Toronto neighbourhoods, and looking at the average rent for condominium apartments by month since July 2019, most areas are still experiencing rent declines.

Rent per square foot for condos in High Park-Swansea were up 4.5% annually to $3.51 psf, but the number of listings is relatively low, which contributes to the monthly volatility of the average rent levels.

Regent Park has seen rents increase by nearly 10% year over year, but the rent level in July of 2019 appears to be an outlier, the market has been fairly flat between $3.55 psf and $3.65 psf since August of 2019.

The biggest drop is the Waterfront Communities-The Island, which is a large swath of south central Toronto that encompasses much of the most recently completed new condo supply.

The average asking rent per square foot fell from $3.95 psf to $3.58 psf from July of last year to July 2020 (-9.4%) .

Downtown Toronto has lost some of its value in the “work from home” era.

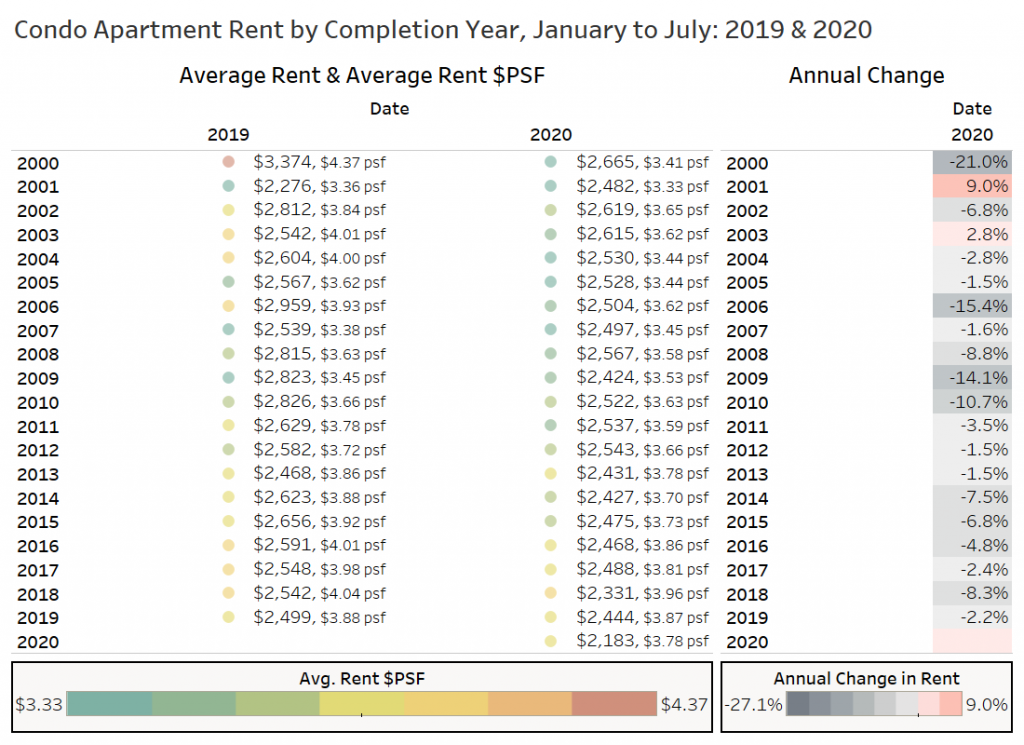

Condo rental rates are trending downward, and the chart below looks at the average rent and average rent per square foot for Toronto condos by the year the building was completed. Only developments that completed construction over the past 20 years were included.

The average monthly rent was down in 18 of the 20 years. For buildings completed in 2019, the average unit was available for just under $2,500 from January to July 2019, and that has dropped 2.2% to $2,444 per month, however the rent per square foot is virtually unchanged at $3.88 psf.

Having your building completed during a pandemic has not been good for the 2020 buildings, with an average asking rent of $2,183 per month, which is the lowest of any year on the list. The units are small at about 580 square feet, compared to about 635 square feet in 2019.

The $3.78 psf rent for buildings completed in 2020 is lower than buildings completed from 2016 to 2019.

Rental Rates by Projects

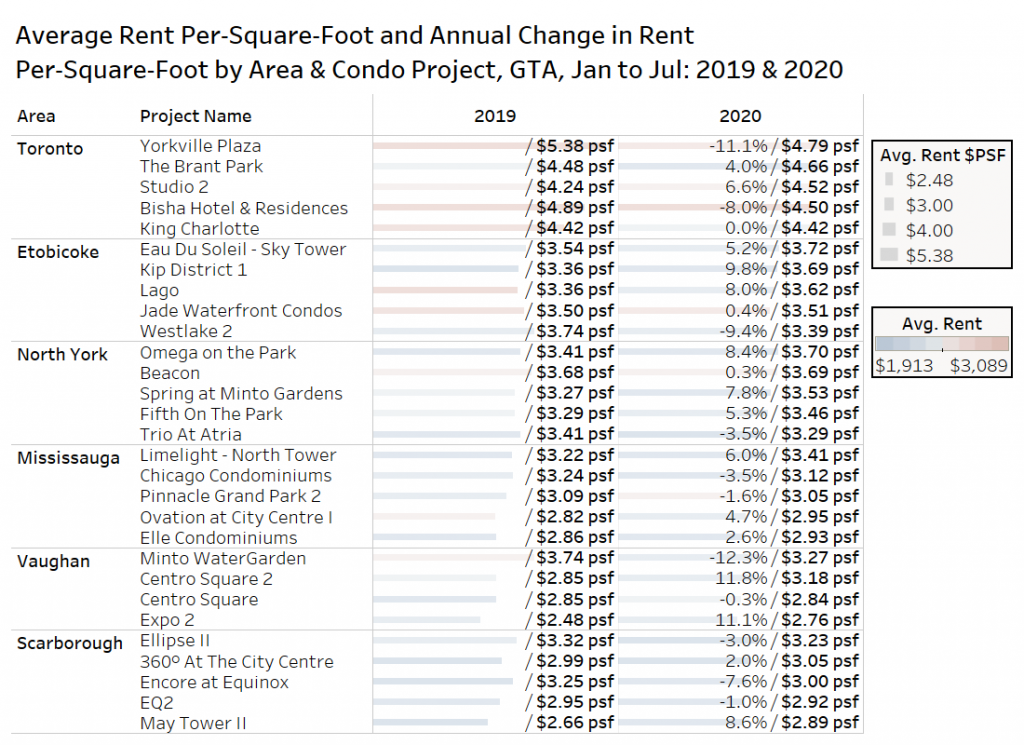

When trying to evaluate the market on an apples-to-apples basis, looking at individual projects assists in that measure allowing for control over location and interior finish of the suites.

The chart below looks at the average rent and average rent per square foot for several high-activity condo developments in various municipalities, with Rentals.ca listing data from January to July 2019 versus January to July 2020.

Surprisingly, only 11 of the 29 properties shown have experienced a decline in average rent per square foot year over year.

Conclusion

When looking at data on the average rent for all property types in the Greater Toronto Area, the market continues to experience a decline. However, when breaking down the data by property type, municipality, neighbourhood, and project, conflicting results arise. Rental apartment rents are up 2% annually on average, while average condo rents are down 10% annually.

When zooming in on the former City of Toronto, condo rents have declined 13% year-over-year, but on a per-square-foot basis, the decline is not as dramatic at -5%.

It doesn’t matter how old the condos are, rent declines appear to be impacting all products available. If the rental market continues to soften, look for more investors to sell their suites, as the July data indicates more strength in the resale market with sales up 7% annually, and prices up 9% annually in the GTA.

It is still too early to tell if the re-opening of the economy will result in increased rental demand, but owners and landlords will have to be more creative in marketing their properties given the increase in competition and vacancies.

We will continue to monitor the market and report our findings here.