Greater Toronto Area Rental Market

The Average Rent for All Property Types in the GTA Declined by 16% Annually in December 2020

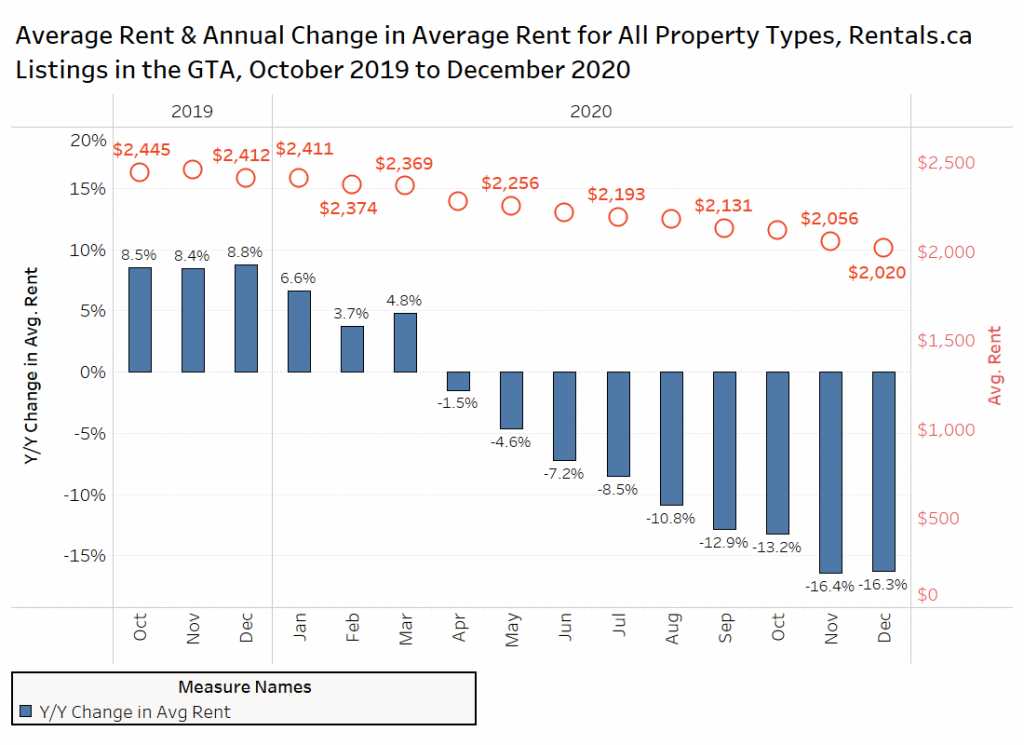

The chart below presents data on the average monthly asking rent for GTA rental listings (all property types: basement apartments, rental apartments, condo apartments, townhouses and single-family homes) from October 2019 to December 2020 based on listings data on TorontoRentals.com. The average rent is shown via the coin symbols, with the shade of red representing the median rent level.

The average rent for all property types was $2,020 per month in December 2020, the 13th consecutive monthly decline. The average rent is down 1.75% monthly, and 16.3% annually (as shown via the blue bars). In the three months prior to the first lockdown in March 2020, rents were increasing by 4% to 6% year over year and by almost 9% annually in Q4-2019.

Average Rental Rates by Bedroom Type

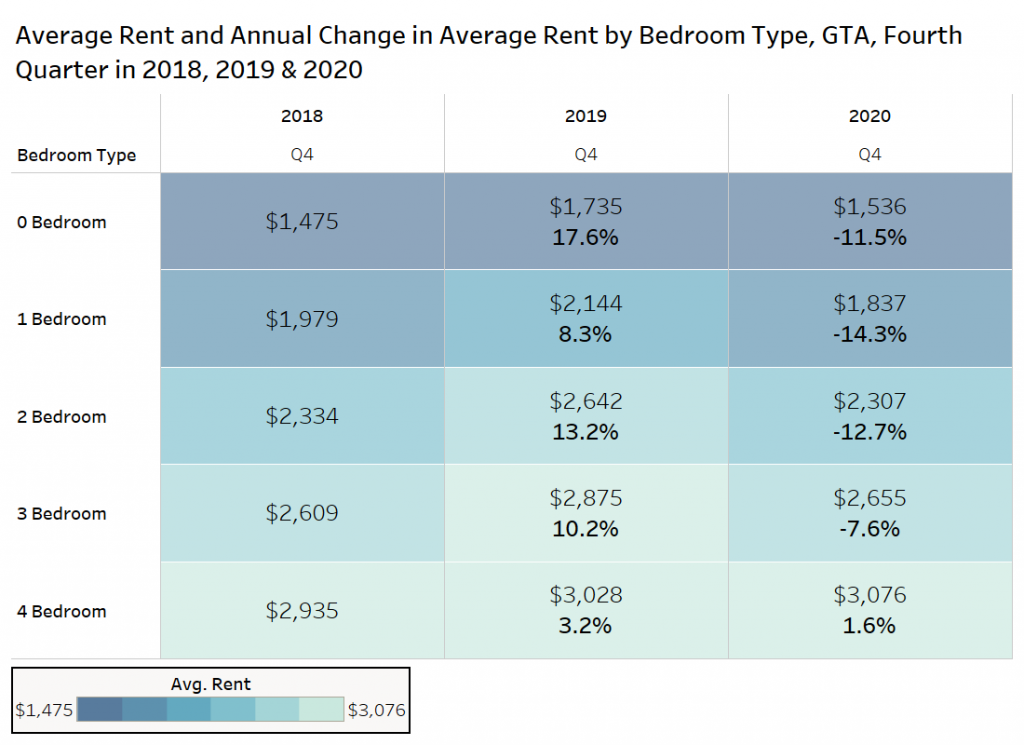

The average rent by bedroom type in the GTA for all property types in the fourth quarter of 2018, 2019 and 2020 is shown in the chart below. Five- and six-bedroom units have been removed from the chart, as the small sample sizes lead to monthly volatility.

Average Asking Rents for One-Bedroom Units Down about 14% annually

Studio units experienced rent growth of 18% annually in the GTA in Q4-2019, but average rents have declined 12% annually in 2020.

One-bedroom units decreased by 14%, the steepest decrease of all bedroom types. Year-over-year average rent declined by over $300 per month to $1,837, a rental rate lower than the average rent of $1,979 in Q4-2018.

Two-bedroom units also experienced a significant decline of 12.7% from Q4-2019, $335 per month lower. Average rents had increased by nearly $310 in 2019 and all of that growth was erased.

Three-bedroom units fared better than studios, one- and two-bedroom units. Average rent decreased by 7.6% in Q2-2020. The average rent for a three-bedroom unit in Q4-2020 was $2,655, only $13 per month higher than a two-bedroom unit in Q4-2019.

Four-bedroom units, which are primarily suburban single-family or townhouses, was the only category to experience rent growth, and showed a nominal, albeit positive, year-over-year increase of 1.6%. The sample size is not large in comparison to the other bedroom types, and the results are volatile on a monthly basis as the composition of the sample changes rapidly (based on location, lot size and unit size).

It is clear from the data and anecdotal evidence that tenants are seeking out more space while working from home. With students staying home in early 2021, expect that trend to continue as parents with children look for more space to conduct virtual learning. With rents declining as they have, tenants in a two-bedroom unit can almost afford a three-bedroom unit at the same rent level they paid for their two-bedroom unit last year.

Average Rental Rates by Property Type

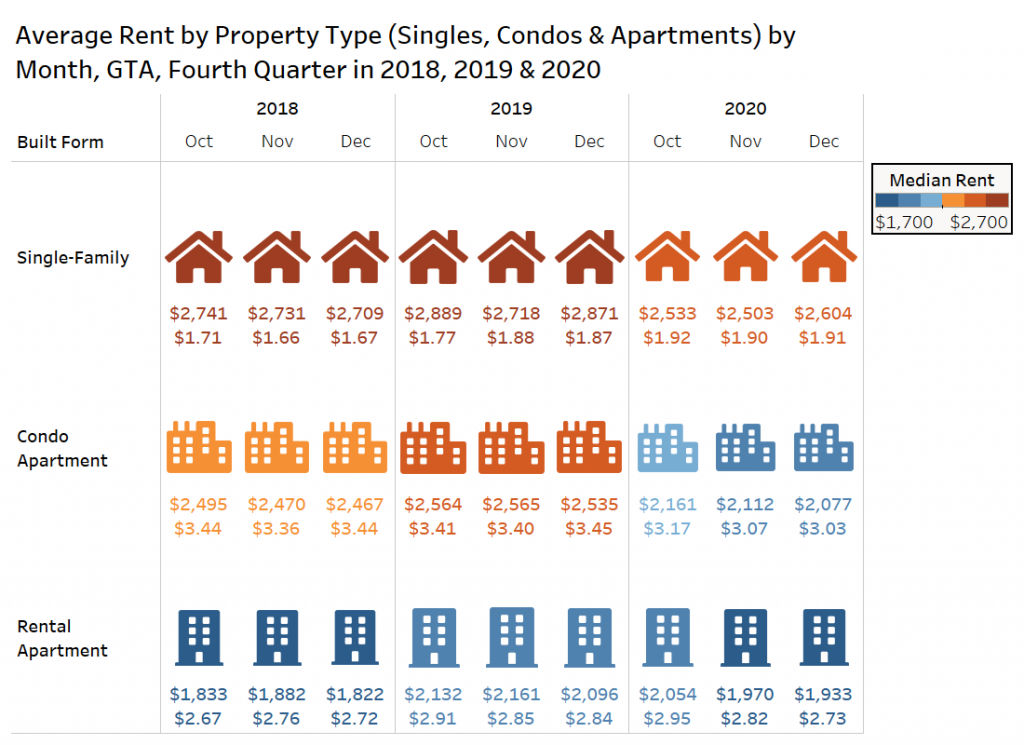

The next chart presents GTA data on the average rent and average rent per square foot for single-family homes, condominium apartments, and rental apartments by month in the fourth quarters of 2018, 2019 and 2020 via TorontoRentals.com listings data.

GTA Condo Rents are Down 18% Annually

Condo apartment rents continued their decline in Q4-2020, with December 2020 average rent falling 18.1% compared to December 2019, from $2,535 to $2,077. Average rent per square foot (psf) was down $0.42 psf year over year (-12.2%).

In December of 2019, the average rent for single-family properties in the GTA was about $2,870 per month, an increase of 6% annually, while in December 2020, average rent declined by 9.3% year over year to just over $2,600 per month.

Rental apartment average rents dropped to $1,933 in December 2020, about $160 lower than the December 2019 level, an 7.7% annual decline. Rent per square foot decreased by 4% year over year. The rental apartment category is the only property type to have higher average rents in December 2020 than December 2018.

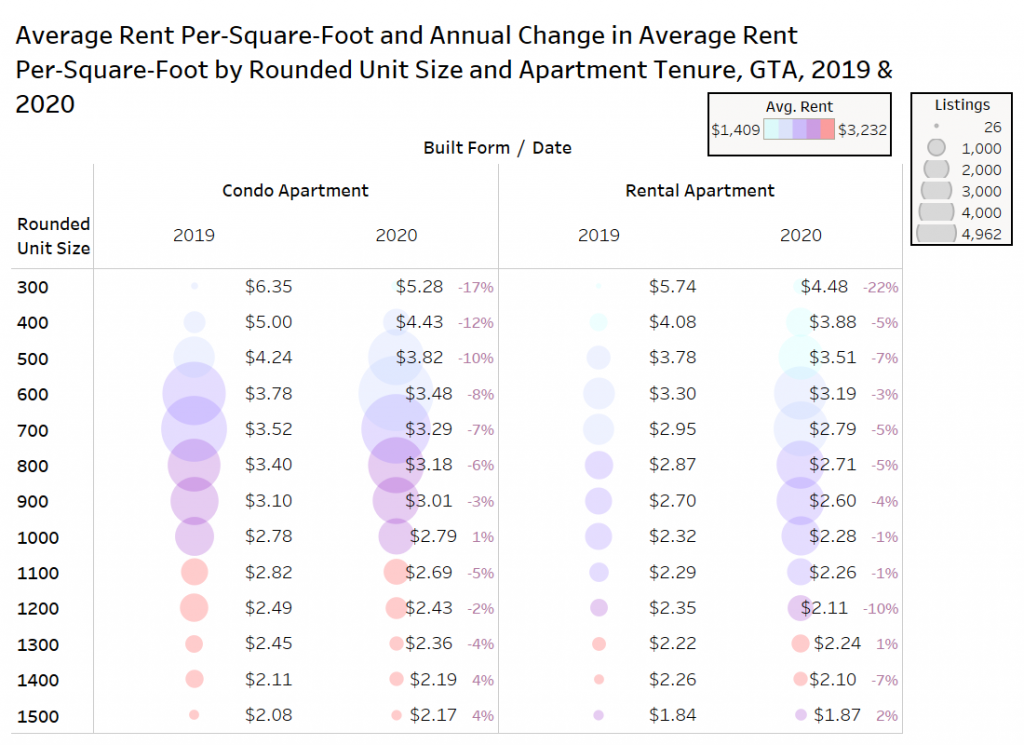

Average Rental Rates by Rounded Unit Size

Data on the average rent per square foot and annual change in rent per square foot for condominium and rental apartments by rounded unit size is presented in the chart below. Suites from 250 square feet (sf) to 1,549 sf are rounded to the nearest hundred to examine the asking rents in 2019 and 2020. The colour of the markers indicates the average monthly rent, and the size of the marker reflects the number of listings for that category.

The TorontoRentals.com data is not comprehensive, but the number of listings on the website grew substantially in 2020 compared to 2019, and the vacancy rate in the GTA is expected to be much higher in 2020 compared to 2019.

Average rent per square foot for almost every unit size for both condo and rental tenures experienced year-over-year declines in 2020. Only the largest units experienced rent increases year over year in 2020, with only 1,500 sf units increasing for both condo and rental apartments.

The greatest declines for both condo and rental apartments were at the smallest unit size, 300 sf. Condo apartments declined by 17% to $5.28 psf, while apartments declined by 22% to $4.48 psf. These small condo rentals and apartments had the highest rental rate per square foot at $5.28 and $4.48 respectively, but also had the fewest number of listings.

With people working from home, small units have fallen out of favour, and with many of these units in the downtown area and used by students and young professionals just starting out, the pool of available tenants has shrunk substantially.

With record completions scheduled for 2021, there should be even more of these micro suites hitting the rental market, as they were popular with new condo investors looking to buy the cheapest units in these projects.

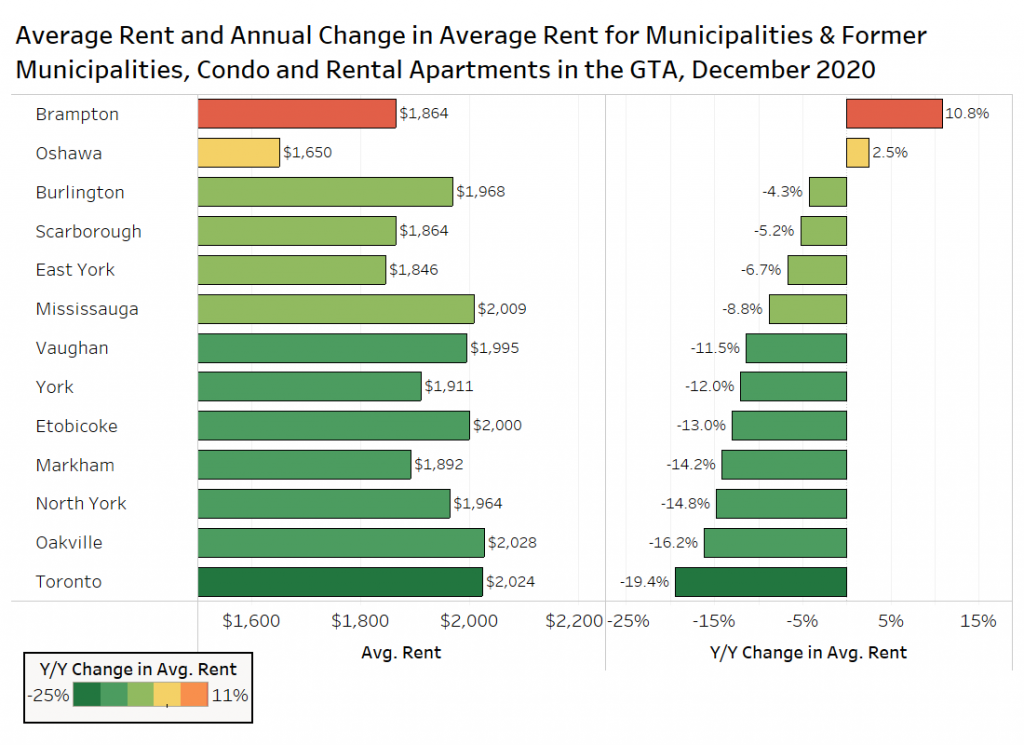

Average Rents for Condo & Rental Apts by Municipality

Average Annual Rent Down 19% in Toronto, Brampton Up By 11%

The chart below presents data on the average rent for condominium rentals and apartments in select GTA municipalities in December 2020 (Toronto is broken up into its former municipalities, prior to amalgamation).

Brampton, a municipality currently in the news for high COVID-19 rates, experienced a 10.8% increase in average rent, the only municipality in the sample with an increase of over 3%, bringing the monthly rate to $1,864, a rate equivalent to Scarborough. Brampton rental apartments increased by 6.5% annually, while townhouse rentals increased by 10.1% annually. Part of the rise can be attributed to a change in the composition of listings, with more townhouses and condo apartments compared to 2019.

Oshawa, the only other municipality with an increase in year-over-year average rent had the most affordable suites at $1,650 per month. Outside these two markets, the suburbs continue to experience notable rent drops, with the “905” municipalities of Richmond Hill, Vaughan, Markham and Oakville all experiencing double digit decreases ranging from 11.5% in Vaughan to 16.2% in Oakville.

The annual change in average rent in pre-amalgamation Toronto declined 19.4% in December of 2020, with average rent at $2,024. The following section will zoom in on the former city of Toronto in greater detail.

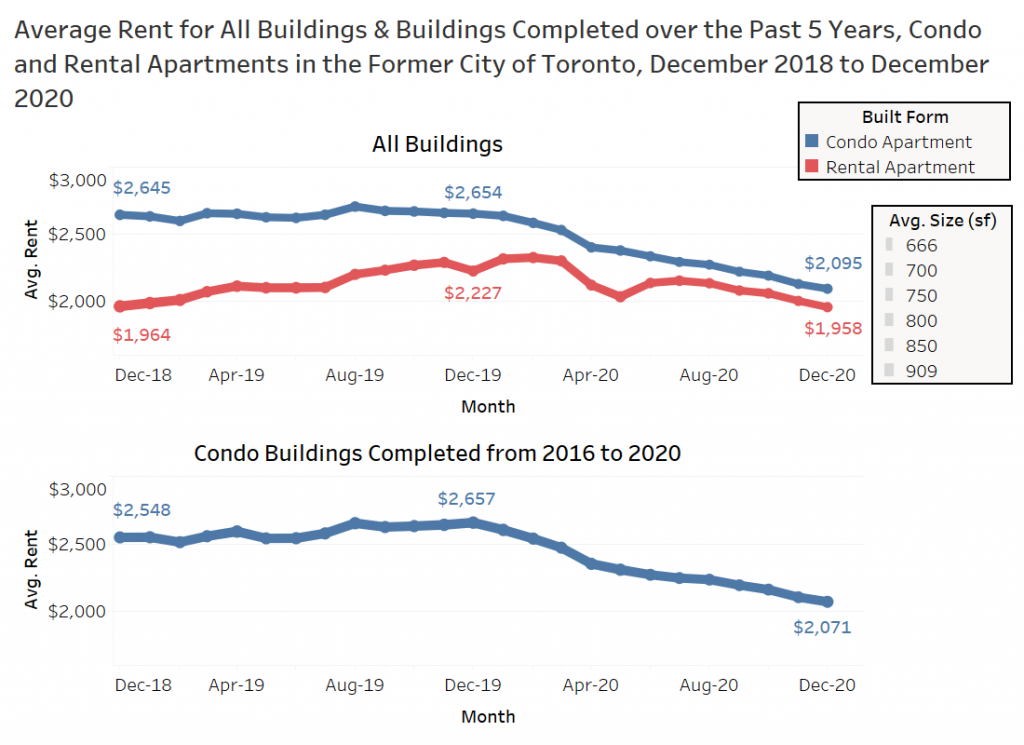

Condo and Rental Apartment Average Rent Levels by Age

Data on the average rent for condo and rental apartments in the former city of Toronto from December 2018 to December 2020 is visualized in the next chart, with all buildings shown in the top panel, and condo buildings completed over the past five years in the bottom panel.

In 2019, the average rent for condominium rentals was virtually unchanged year over year (~$2,650 psf month). In 2020, the average rent has declined 21% to $2,095 per month. Looking at condo buildings completed over the past five years, the data is nearly identical over the last 12 months, dropping 22% annually to $2,071 per month. The buildings completed from 2016 to 2020 had an average unit size of about 640 sf in December 2020 versus 680 sf for all of the condo buildings.

The purpose-built rental apartment market in the former city has also declined in 2020, following a 13% rise in 2019. In December 2019, the average rent was $2,227 per month, falling 12% to $1,958 per month in the final month of 2020.

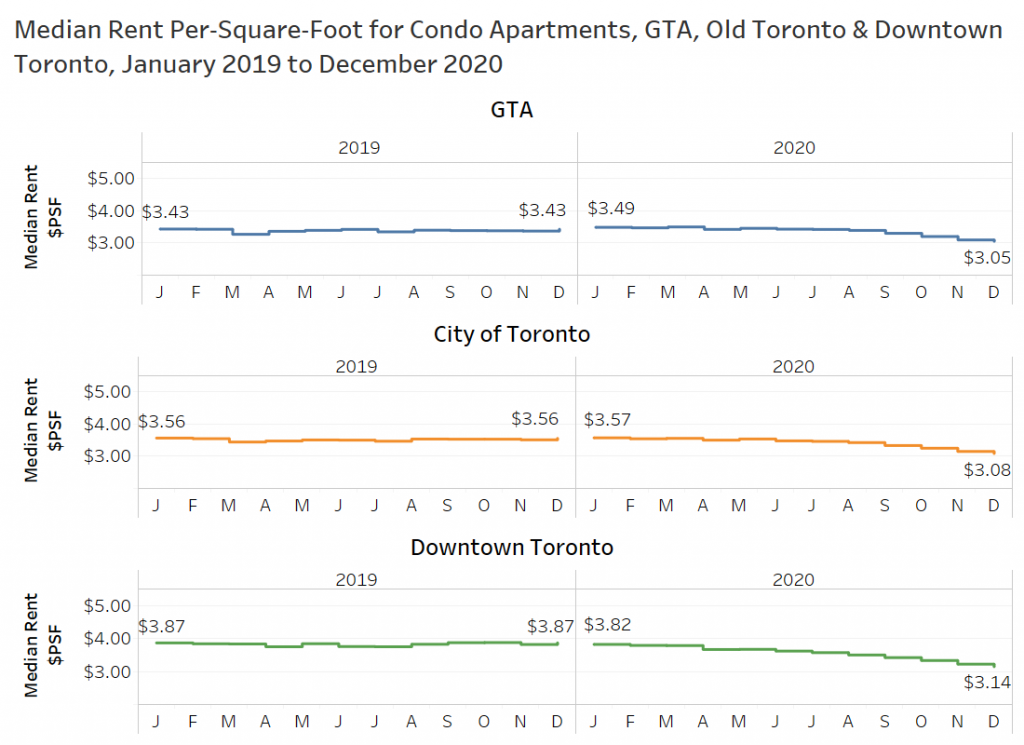

Condo Apartment Rent Levels Per Square Foot

In 2019, the median rental rate per square foot for condominium apartments for rent in the GTA was flat at $3.43 psf (refer to the chart below). The same stagnant rent levels were experienced in the city of Toronto at about $3.56 psf, and downtown Toronto at $3.87 psf in 2019.

However, condo investors are being hit hard during the pandemic, with GTA median rent per foot down 11% annually, the amalgamated city of Toronto has seen rents decline by 13% annually, and downtown Toronto has seen average rents decline by 19% annually.

The downtown or central Toronto rent premium has nearly evaporated completely. In December 2019, downtown Toronto was commanding a premium of about 13% over the GTA overall, in December 2020 that premium had shrunk to just 2.5%.

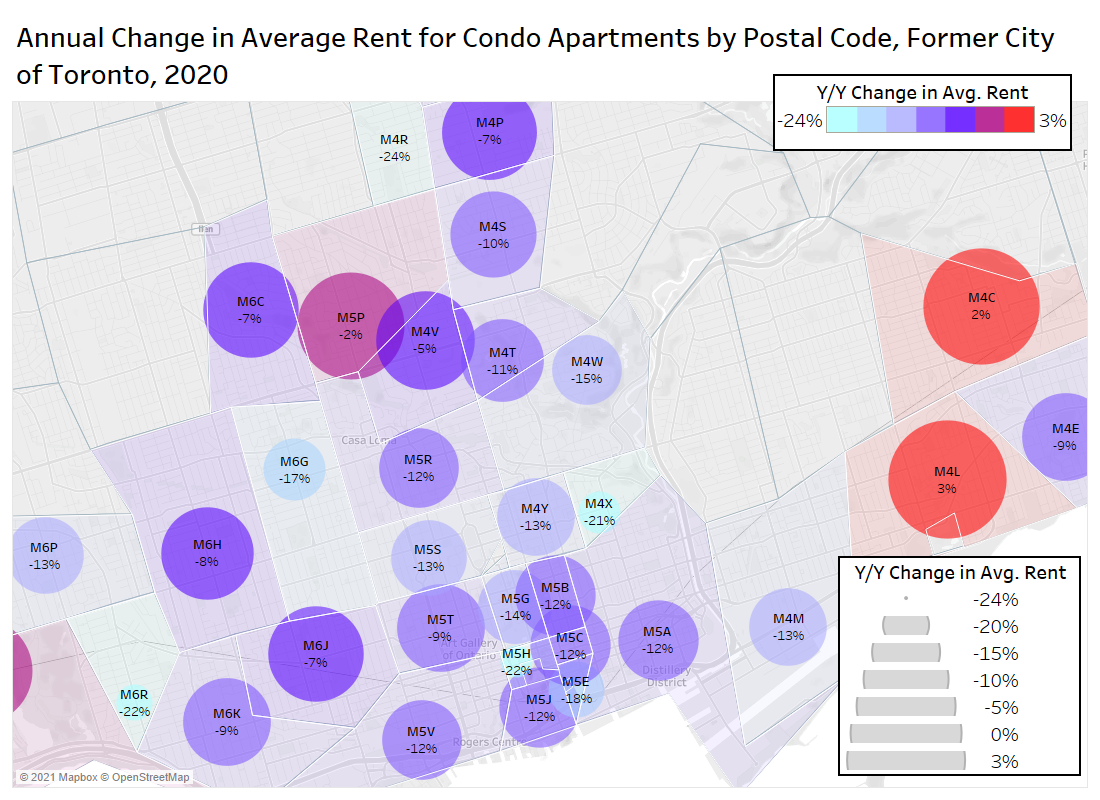

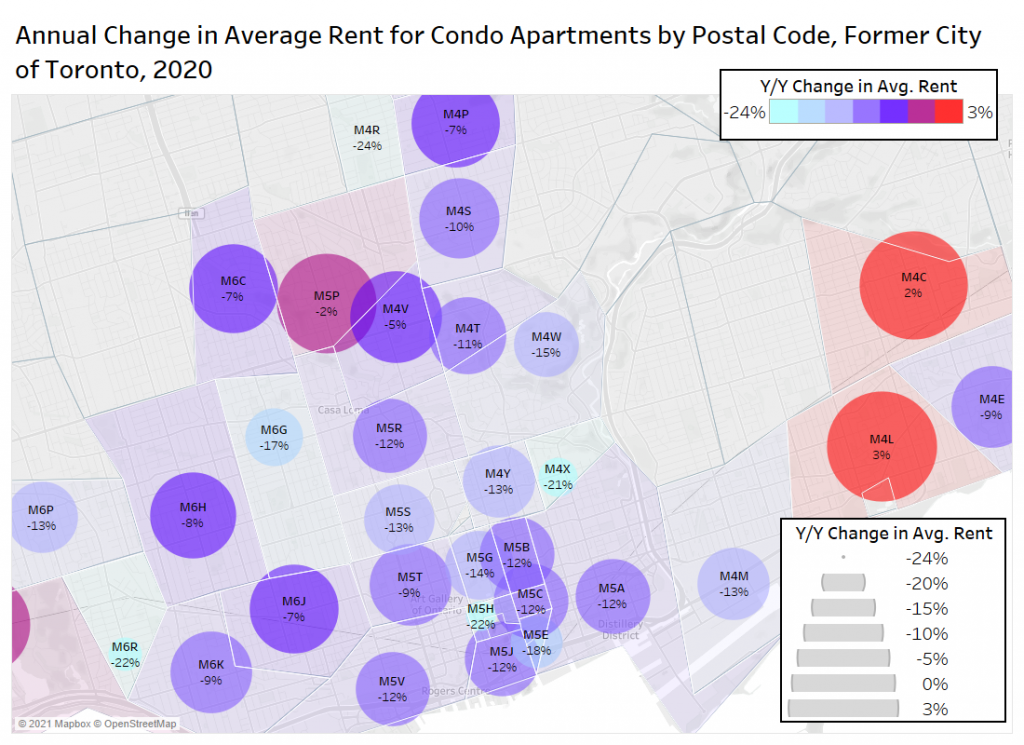

Annual Change in Condo Apartment Rent by Postal Code

The map below looks at the change in average rent by postal code for condominium apartments in 2020 versus 2019. The larger the circle, the higher the growth.

Most of the postal codes in the downtown core declined by double-digits, with the most active area, M5V (King West, Entertainment District), experiencing a 12% drop. The M4S postal code that includes Davisville and the southeast quadrant of Yonge and Eglinton declined by 10% annually, while M4P to the north declined by 7% annually.

Two east end postal codes saw rents increase in 2020 (M4C and M4L), but that is likely due to new completions pulling the average up, where the majority of the supply was older condo stock.

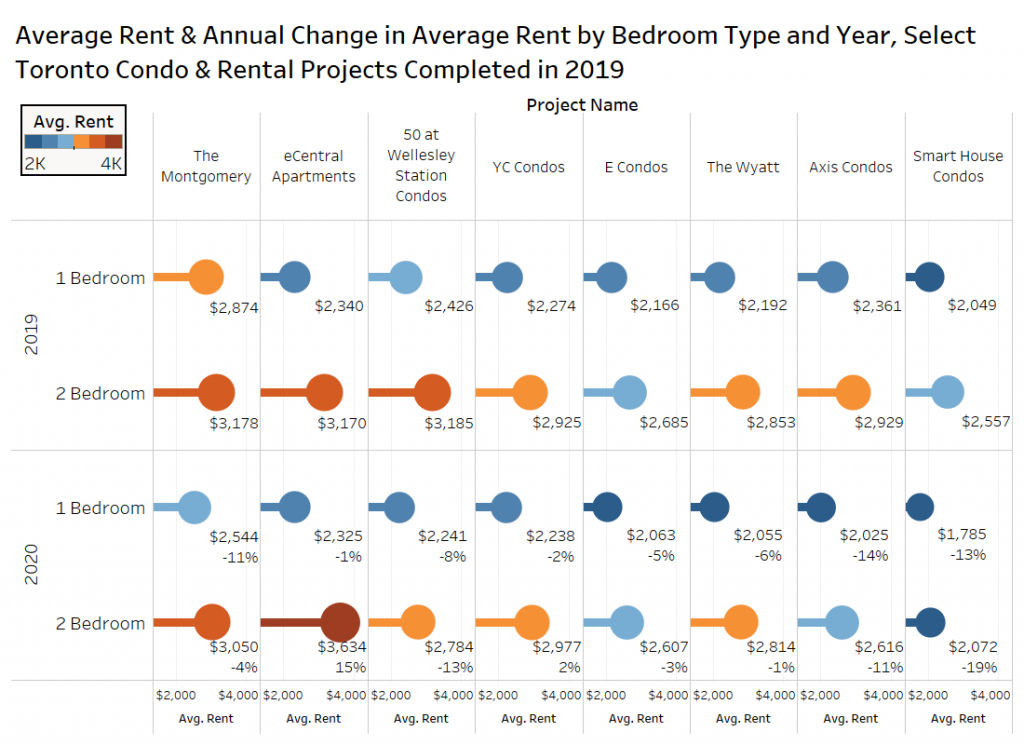

Rental Data at Select 2019 Completions by Bedroom Type

The chart below shows several of the most active condo and rental apartment projects completed in 2019 based on listing activity on TorontoRentals.com over the past two years. The average one-bedroom and two-bedroom rental rates are shown for 2019, with 2020 also adding the annual change in those averages.

The two downtown Toronto projects, Axis Condos and Smart House have experienced the biggest declines, with the projects experiencing rent declines in 2020 of 13% to 14% for one-bedroom units. One of the least impacted projects is YC Condos near Yonge and Carlton, with declines of just 2% for one-bedroom suites, and an increase of 2% for two-bedroom condos.

The Montogmery and eCentral are both new purpose-built developments near the intersection of Yonge and Eglinton. eCentral is offering one month free. If the development offered one-bedroom units at $2,340 per month on average in 2019, that’s $28,080 in revenue, and if eCentral collected $2,325 per month in 2020 for just 11 months, that’s $25,575 in revenue, a decline of 9%.

Conclusion

With a second lockdown announced late last year in Toronto and more stringent stay-at-home orders introduced in early 2021, it does not look like downtown offices are going to be opening any time soon, and the borders are likely to stay closed for some time. The vaccine rollout is occurring slowly, but there is no indication that the decline in rents is going to stop any time soon.

According to many Realtors, the market for resale condominiums is picking up, and investors are looking for deals as prices declined year-over-year in the GTA in December. Despite the eviction ban, the more stringent AirBnB rules, and the rapid decline in rents, investors appear to be bullish on the outlook for condos. However, it is difficult to assess whether these investors are buying existing investor units, or buying from end-users, and thus further increasing rental supply. This makes a difference in whether this phenomenon will ultimately help or hurt the rental market.

The first half of the year will likely remain a challenge for landlords and owners as tenants have a lot of choice, and based on the recent data, they have benefitted from waiting further as rents have declined at a rate faster than at any time over the past couple decades.